How much can i borrow on shared ownership

The loan is secured on the borrowers property through a process. The cosigner has no right to the property but guarantees they will pay the loan if the primary borrower defaults.

How Much Of A Deposit Do You Need For Shared Ownership Mortgage Light

If youre applying for a mortgage jointly with someone else lenders will use your combined incomes to determine how much you can borrow which usually works out to much more than either applicant could afford on their own.

. A shared ownership mortgage calculator lets you know how much you could borrow. We dont currently offer Shared Equity schemes online so please either give us a call or visit us in branch. These names refer to the way a borrowed parameter receives a shared borrow as opposed to the exclusive borrow on an inout parameter whereas a taken parameter becomes owned by the callee.

With a Shared Equity mortgage youll receive an equity loan which well treat as part of your deposit. The amount you are able to borrow will help you determine the size of the further share you are. Simply purchase a share in a brand-new home and pay a subsidised rent on the remaining.

Its different to a residential mortgage as instead of buying the whole property you buy a share. Outside London you could look. You can also input your spouses income if you intend to obtain a joint application for the mortgage.

If this is also happening to you you can message us at course help online. Market circumstances and competition between lenders can also lead to interest rate changes which can affect the interest rate of your loan. Properties at this phase are called Real Estate Owned or REOs.

Shared Ownership just with a non-branded name. Bangkok September 6 2022 Bitkub Blockchain Technology Bitkub Chain and Bitkub NFT developer invite you to open the new experience of the digital world and participate in the NFT activities at Bitkub NFT Fair event on September 10-11 at Bitkub M Social Helix Building 9th floor The Emquatier. This loan is repaid either on the sale of the property or the end of the mortgage term whichever comes first.

American Family News formerly One News Now offers news on current events from an evangelical Christian perspective. A mortgage loan or simply mortgage ˈ m ɔːr ɡ ɪ dʒ in civil law jurisdicions known also as a hypothec loan is a loan used either by purchasers of real property to raise funds to buy real estate or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged. What is a Buy to Let mortgage.

The rate can be influenced by changes in the Reserve Bank of Australias official cash rate or the lenders own costs. Weve told Rust that the lifetime of the reference returned by the longest function is the same as the smaller of the lifetimes of the references passed in. Note this is for flexible shared ownership home loans properties only fixed shared ownership loans can only be sold back to the Housing Authority.

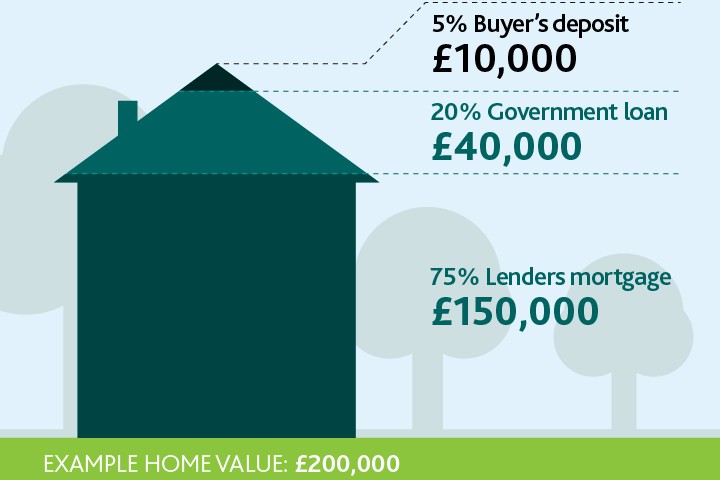

Cosigning One borrower takes out the loan and owns the property it pays for. This loan is repaid either on the sale of the property or the end of the mortgage term whichever comes first. You can borrow the remaining 55 from a commercial mortgage lender.

Both Cosigners and joint borrowers are 100 responsible for the loan including the. Yet while the concept of shared ownership is straightforward in practice it can be both complicated and expensive. You pay rent on the rest.

Of course this depends on both parties circumstances and the addition of an applicant with very little or no income. With a Shared Equity mortgage youll receive an equity loan which well treat as part of your deposit. A Buy to Let mortgage is a loan secured against one of these properties.

Whenever students face academic hardships they tend to run to online essay help companies. We will ensure we give you a high quality content that will give you a good grade. Youll pay a mortgage on your share then pay rent on the rest.

Because banks play an important role in financial stability and the economy of a country most jurisdictions exercise a high degree of regulation. Depending on how much you want your monthly payment to be and how much you have available to put down you may be able to choose between a 15-year or a 30-year loan and many lenders will create a loan for you with custom terms. Lending activities can be directly performed by the bank or indirectly through capital markets.

Start online or you can call 1300 578 278 to chat with our team. Read the latest commentary on Sports. Shared Ownership provides an affordable way to buy a property.

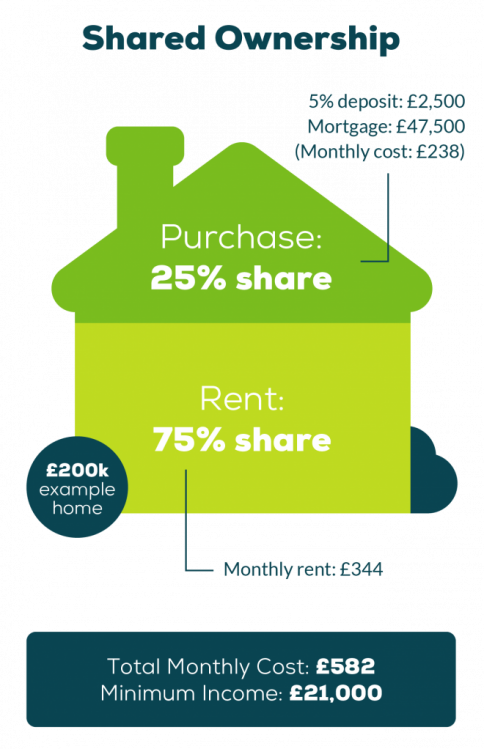

Thats where shared ownership mortgages can help. Under the shared ownership program you can purchase a share of your home and pay rent on the remaining mortgage. We can handle your term paper dissertation a research proposal or an essay on any topic.

Shared ownership what were referring to on this website The same as Help to Buy. With the shorter loan you will often get the very best interest rate Brown says. Once the formal foreclosure processes are underway these properties can be purchased at a public sale usually called a foreclosure auction or sheriffs sale.

Joint loan Borrowers take out the loan together and jointly own the property the loan pays for. Shared ownership is a type of mortgage. Like any form of investment theres a lot to consider before you make the jump as.

Find out how much you can borrow - so youll know how much you can afford before you put in an offer. Buying part of a property through shared ownership is one way of getting a foot on that first rung of the ladder a ladder thats become harder to climb as property prices continue to soar. A Buy to Let property sometimes referred to as buy to rent or BTL is a type of property investment in which the investor becomes a landlord and rents out the property for profit.

Therefore the borrow checker disallows the code in Listing 10-23 as possibly having an invalid reference. You only pay a mortgage and deposit on the share you own. You can use the above calculator to estimate how much you can borrow based on your salary.

You buy a share usually 25-75. When you buy a shared ownership home you buy between 25 and 75 of its value and pay rent on the rest. Help to Buy Shared Ownership.

In the future if you wish you can usually buy further shares until you own your home outright. A bank is a financial institution that accepts deposits from the public and creates a demand deposit while simultaneously making loans. As well as how much rent youll have to pay on the rest of the property.

If youre a first time buyer saving a big deposit can be tricky. Our experienced journalists want to glorify God in what we do. You need to put in.

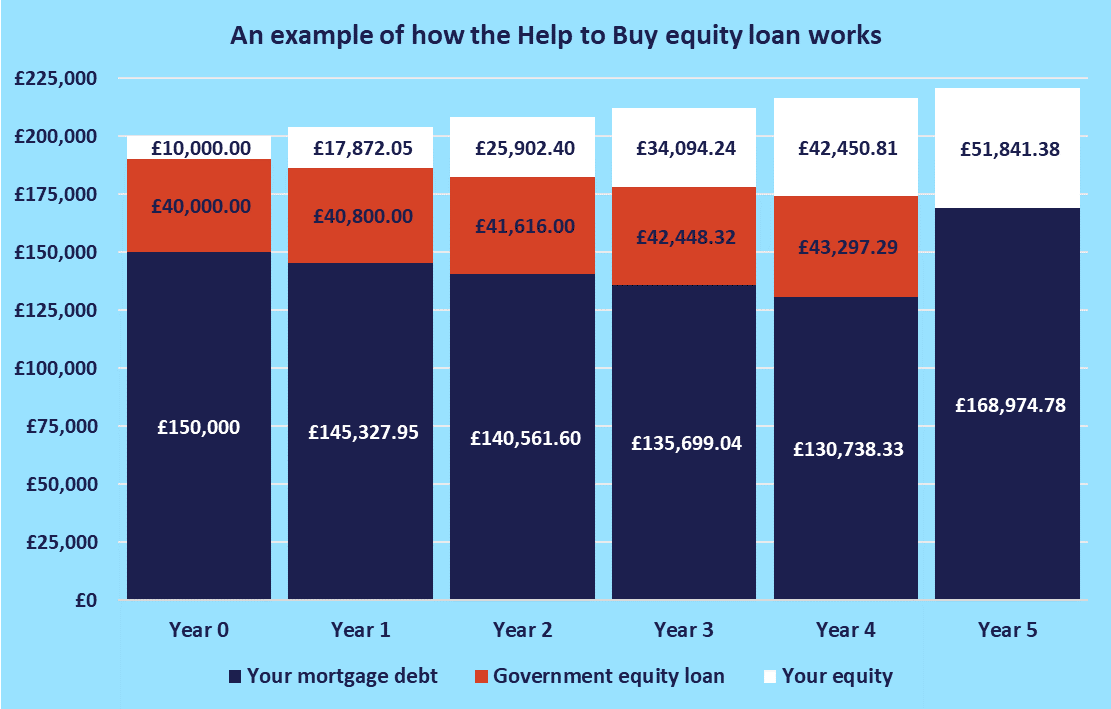

This guide sets out how the scheme works in England who can take part and. The government will loan you 40 of the purchase price. London Help to Buy loans are available on new-build properties worth up to 600000.

Stay up-to-date on the latest news schedules scores standings stats and more. However the compiler cant see that the reference is valid in this case. We dont currently offer Shared Equity schemes online so please either give us a call or visit us in branch.

The current implementation in the compiler uses __shared and __owned and we could remove the underscores to make these simply shared and owned. The interest rate on a variable rate home loan can change at any time either up or down. You buy a share usually 25-75.

Shared ownership can be cheaper than renting but it isnt always so youll need to do. If the property does not sell at the public auction then ownership of the property is returned to the lender.

Ultimate First Time Buyer Guide How Much Money Do You Need To Buy A House

Your Resi Home

A Guide To The Government S Help To Buy Schemes Foxtons

Is Shared Ownership A Good Idea Mortgage Light

Help To Buy And Shared Ownership What You Need To Know About First Time Buyer Schemes In London

Shared Ownership Mortgages September 2022 Forbes Advisor Uk

A Guide To The Government S Help To Buy Schemes Foxtons

Considerations For Shared Ownership Of Family Property

Shared Ownership Is It Right For You Barclays

Can I Get A Shared Ownership Mortgage With Bad Credit Haysto

Is Shared Ownership A Vital First Step On The Property Ladder Or A Slippery Slope Property The Guardian

We Re Selling A Shared Ownership Home What Is A Fair Price Property The Guardian

What Is A Shared Equity Mortgage And How Does It Work Unbiased Co Uk

Compare Shared Ownership Mortgages Uswitch Uswitch

Shared Ownership Mortgages Explained Nerdwallet Uk

What Is A Shared Ownership Mortgage Help And Guidance Lloyds Bank

Is Shared Ownership A Vital First Step On The Property Ladder Or A Slippery Slope Property The Guardian